All Categories

Featured

That's not the exact same as spending. They will certainly not only want you to purchase the item, they want you to go right into service with them, join their team. Ask on your own, has this individual who's marketing this product to me been doing this for 5 years or at the very least 10 thousand hours' worth of solutions?

I want you to be a professional, a master of all the expertise required to be a success. So do not, Manny, if you do this, don't call a pal or family for the first five years. And after that, by the way, you wish to inquire that in the interview.

Whole Life Vs Indexed Universal Life

I mean, that's when I was twenty-something-year-old Brian being in his money course, and I was looking about, going, 'What do these people do after they finish?' And all of them go help broker-dealers or insurer, and they're selling insurance coverage. I moved over to public audit, and currently I'm all thrilled due to the fact that every moms and dad is usually a CPA that has a kid in this night.

That's where wisdom, that's where expertise, that's where know-how comes from, not even if somebody loves you, and now you're gon na go transform them right into a client. To find out more, look into our free sources.

I indicate, I am a monetary solutions specialist that cut her teeth on entire life, but who would adopt this theory centered around buying only term life insurance coverage? Given, term is a cost-effective kind of life insurance, yet it is also a short-term kind of insurance coverage (10, 20, 30 years max!).

It guarantees that you live insurance coverage past thirty years no matter the length of time you live, actually and relying on the kind of insurance coverage, your premium amount may never ever change (unlike eco-friendly term policies). After that there is that whole "invest the difference" thing. It actually massages me the upside-down.

Keep it real. If for no other factor than the reality that Americans are awful at conserving cash, "acquire term and spend the difference" must be outlawed from our vocabularies. Be individual while I drop some expertise on this point: According to the U.S. Social Safety And Security Management, the ordinary American's yearly wage was $42,979.61 in 2011; Yet, only 14.6 percent of American households had fluid possessions of $50,000 or more during that same duration; That indicates that much less than 1 in 4 family members would have the ability to replace one income-earner's incomes need to they be out of work for a year.

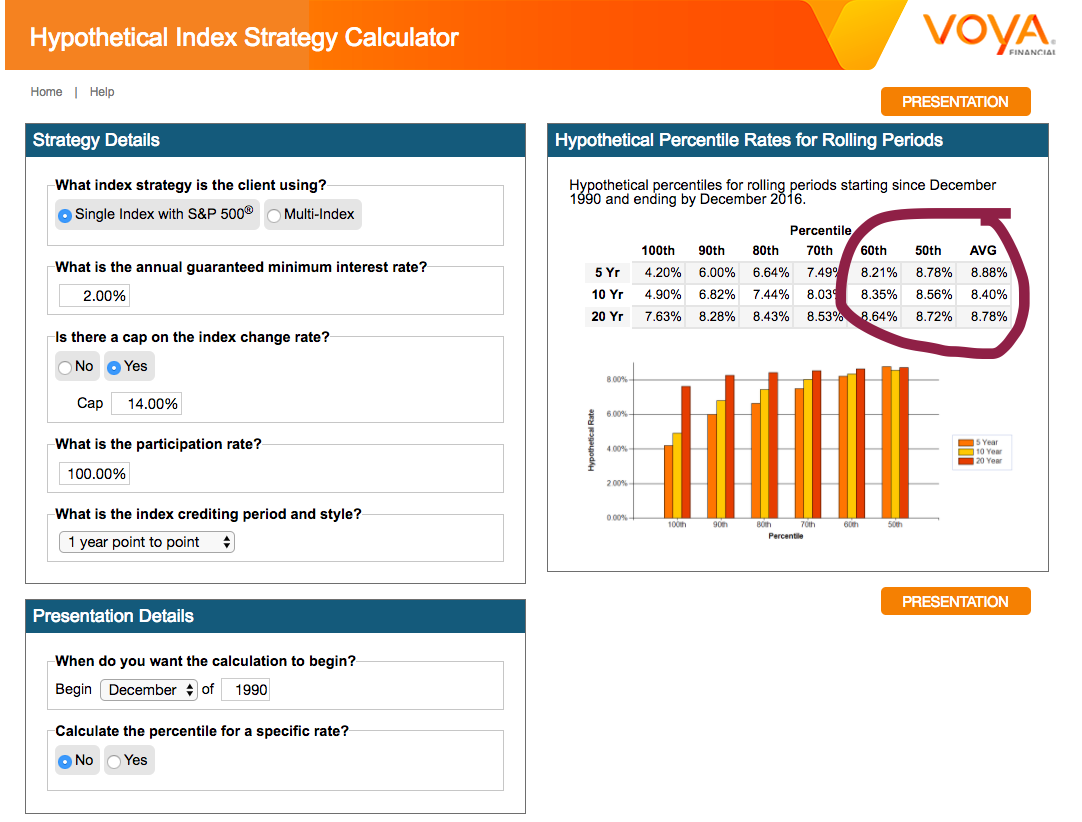

What happens if I informed you that there was a product that could aid Americans to acquire term and invest the distinction, all with a solitary purchase? Here is where I get just downright kooky. Watch closelyHave you ever before researched just how indexed universal life (IUL) insurance technically works? It is a sort of money worth life insurance policy that has an adaptable costs payment system where you can pay as much as you would certainly such as to accumulate the cash money worth of your plan quicker (based on particular limits DEFRA, MEC, TEFRA, etc). universal life guaranteed rate.

Latest Posts

Universal Indexed Life Insurance

Benefits Of An Iul

Guarantee Universal Life Insurance