All Categories

Featured

If you're going to utilize a small-cap index like the Russell 2000, you might want to stop and take into consideration why an excellent index fund company, like Vanguard, doesn't have any type of funds that follow it. The reason is since it's a poor index.

I haven't even addressed the straw man here yet, and that is the reality that it is reasonably unusual that you actually have to pay either taxes or substantial compensations to rebalance anyhow. A lot of smart investors rebalance as much as feasible in their tax-protected accounts.

Universal Life Insurance Policy Quotes

And of course, nobody needs to be getting loaded common funds, ever before. It's actually too poor that IULs don't work.

Latest Posts

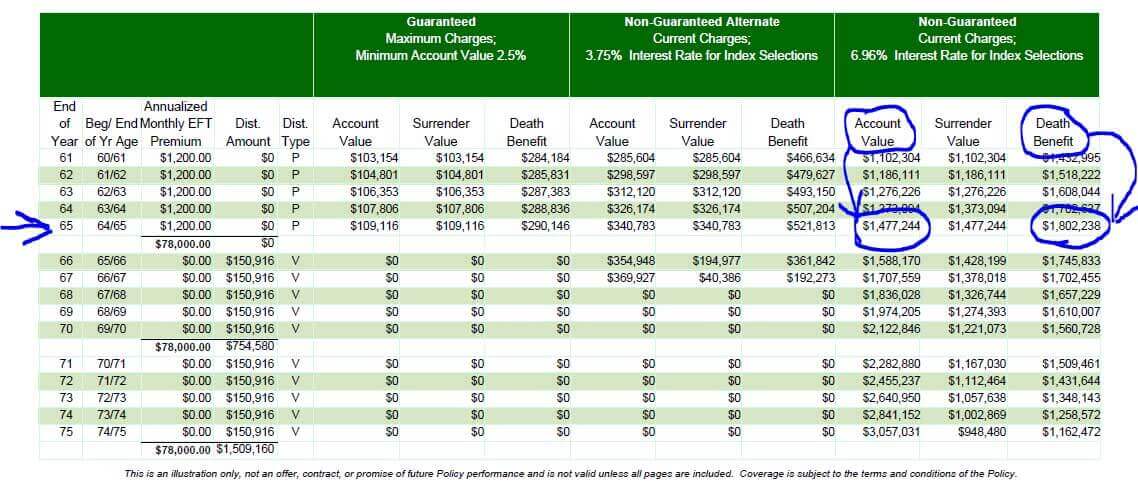

Universal Indexed Life Insurance

Benefits Of An Iul

Guarantee Universal Life Insurance